Making changes to your mortgage

You may need to tell us about changes in your personal details, or you may be thinking about making changes to your mortgage. We’ve provided some more information that you may find useful below.

It’s important that you keep us up to date with your contact details and there’s no fee to make any changes.

We’ll update your phone number as soon as you tell us your new details.

If you’re changing your correspondence address, it will take us a few days to update our records, and as part of this process we’ll also ask you to tell us the reason why. Once the change has been made, we’ll write to you at both your old and new addresses to confirm that our records have been updated.

If your address change relates to a Limited Company, we’ll need to verify this with the records at Companies House. Once the address change is made, we’ll also only write to the new address to confirm the change.

Update your contact details using Self-Serve

You can tell us about a change to your correspondence address or other contact details using Self-Serve, our secure online system, which is available 24 hours a day, 7 days a week.

See our handy guide about how to do this

Please note – if you have more than one mortgage account registered under the same username, you’ll need to make the changes for each account in turn.

Self-Serve is also currently unavailable for mortgage accounts held only in the name of a Limited Company.

Update your contact details in writing or by calling us

You can also tell us your new contact details in writing or by calling us. You’ll find our address, phone number and opening hours on our contact us page.

To help avoid delays, if you write to tell us your new correspondence address, please remember to include your name, mortgage account number and the address of your mortgaged property. You’ll also need to tell us the reason why your correspondence address is changing. Depending on what you tell us, we may need to call you to understand more about this.

To request a change to a registered office, please write to us at:

Jasper Mortgages

PO Box 111

Skipton

BD23 9FA

Your request must be verified by a Certificate of Change of Registered Office Address from Companies House.

Please also remember to include your name, mortgage account number and the address of your mortgaged property in your letter.

If a Director of your Limited Company is changing their name, a new Director is joining or a Director is leaving, please call us.

We’ll talk you through what you need to do so we can update our records.

You can update the name that is held on your mortgage with us, for example if you’ve married or divorced. We don’t charge a fee to make this change.

To do this we’ll need to see:

- A copy of your new signature

- A copy of your old signature

We’ll also need one of the following documents:

- Marriage certificate

- Decree absolute

- Birth certificate

- Change of name deed

- Civil partnership certificate

You’ll need to send the above to:

Jasper Mortgages

PO Box 111

Skipton

BD23 9FA

We’ll return any original documents (e.g. your marriage certificate) by recorded delivery, usually within seven working days.

Certified true copies of the original documents will be accepted. The person who certifies the copy must be a member of a professional body, such as one of the following:

- Solicitor

- Bank or Building Society official

- Chartered Accountant

- Chartered Surveyor

- Dentist

- Doctor

- Minister of Religion

- Councillor

- Person with FCA regulated status

- Post office official (through the post office’s certification service)

- Member of Parliament, or Scottish/Welsh/Northern Ireland Assembly Member

- Serving police officer

- Social worker

- Embassy, consulate, or high commission officer in the country of issue

- Notary Public

- Commissioner for Oaths

Once you’ve given us the information and documents we need, we’ll update your records and start using your new name.

It takes a short time to arrange this, so you might receive letters addressed to your old name for a while.

Please remember – It’s your responsibility to ensure that other official records (such as with the Land Registry) are updated where necessary to reflect your change of name. If you are unsure of how to do this or what else may need updating, we recommend you seek independent legal advice from a solicitor.

To enable someone else (such as a friend or relative) to discuss and obtain information about your mortgage account or make payments on your behalf, you’ll need to request that a third party authority is set up. We don’t charge a fee to do this.

This authority lasts for a maximum of 12 months from the date it’s added, unless you specify a shorter period or tell us that you want it to stop before that.

Giving someone third party authority doesn’t change your agreement with us – it doesn’t make them responsible for your mortgage or give them an interest in your property. Any authority in place also ends on the death of an account holder.

If you’re unsure whether giving third party authority to someone is right for you, we recommend you seek independent legal advice from a solicitor.

How to request Third Party Authority

Please print, complete and post a third party authority form to us. If you don’t have a printer, you can sign in to Self-Serve and send us a secure message or call us and we’ll post the form to you.

When you complete the form, you’ll need to confirm what level of authority you want to give to the third party – whether they can request, obtain and discuss information about your account, whether they can make mortgage payments or whether they can do both.

You’ll also need to ask your nominated third party to complete part of the form and provide a signature.

If the third party is an individual, their signing the form confirms they have received a copy of our Privacy Notice, which explains how we’ll use their personal information. Please ensure they receive a copy of this document or tell them where they can find it on our website.

If there’s anyone else named on your mortgage account and you want to give the third party the authority to act for another borrower too, the other borrower will also need to sign the form.

Once the form is completed and signed by all necessary parties, please post it to us at this address:

Jasper Mortgages

PO Box 111

Skipton

BD23 9FA

Once we’ve received your completed form, we’ll carry out routine checks with credit reference agencies to confirm the identity of the person you are giving third party authority to. These checks won’t leave a footprint on their credit file.

We’ll write to you confirming when the third party authority has been added to your account. This will typically take around seven working days from the date when we receive your request.

You should then let your third party know that the authority is in place, as we won’t tell them directly.

If you have third party authority

If you’ve been given authority as a third party, please contact us to discuss any actions you may wish to take on behalf of our customer.

Power of Attorney is a legal document that allows someone (such as a friend or relative) to make decisions for you. They can act on your behalf if you’re no longer able or no longer want to make your own decisions – such as for long-term physical or mental health reasons.

With Power of Attorney in place, the nominated person (or people) would be able to discuss and obtain information about your mortgage account with us and make payments on your behalf.

We won’t charge you a fee for notifying us that a Power of Attorney is in place, but there may be other costs for you to consider when you set up a Power of Attorney.

If you’re unsure whether giving someone Power of Attorney is right for you, we recommend you seek independent legal advice from a solicitor.

Notifying us that Power of Attorney is in place

Before we’re able to act on a Power of Attorney, we’ll need to see the original court-executed Power of Attorney or a certified copy of it.

We’ll also need anyone named on the Power of Attorney who will be acting on behalf of our customer to supply two documents confirming their identity.

We’ll need one document from this list:

- Current full signed passport

- Disabled persons parking permit

- Resident permit issued to EU Nationals by the Home Office

- Current UK/EU photo driving licence

- Current full UK driving licence (old style)

- Firearms certificate

We’ll also need a second document from this list:

- Most recent mortgage statement

- Current local authority council tax bill

- Current local authority rent card or tenancy agreement

- Current bank / building society/ credit union statement or passbook

- Recent utility bill (not mobile phone) dated within the last three months

- Current UK / EU photo driving licence

- Current full UK driving licence (old style)

We’ll return any original documents by recorded delivery, usually within seven working days.

We can accept certified true copies of the original documents – although the person who certifies the copy must be a member of a professional body, such as one of the following:

- Solicitor

- Bank or Building Society official

- Chartered Accountant

- Chartered Surveyor

- Dentist

- Doctor

- Minister of Religion

- Councillor

- Person with FCA regulated status

- Post office official (through the post office’s certification service)

- Member of Parliament, or Scottish/Welsh/Northern Ireland Assembly Member

- Serving police officer

- Social worker

- Embassy, consulate, or high commission officer in the country of issue

- Notary Public

- Commissioner for Oaths

These documents should be sent to:

Jasper Mortgages

PO Box 111

Skipton

BD23 9FA

After we’ve received and reviewed the necessary documents, we’ll record details of the nominated attorney(s) on the account and then write to our customer confirming this is in place. This will typically take around seven working days from the date we receive the correct documents.

We will not let the attorney know that the authority is in place, as we won’t write to them directly.

Holders of a Power of Attorney

If you hold a Power of Attorney and the steps above have been completed, please contact us to discuss any actions you may wish to take on behalf of our customer.

Ending a Power of Attorney

Once a Power of Attorney is in place, it will be valid for the period specified within the original document, unless our customer advises us, in writing, that this is no longer valid.

If that happens, we’ll then update our records and confirm in writing to our customer that the Power of Attorney has ceased.

A Power of Attorney will also cease upon the death of our customer.

When someone dies, dealing with their financial affairs can be stressful and upsetting. To see details of various organisations and charities offering emotional, practical and financial support, please see our bereavement page.

If you need to tell us about the death of someone named on a mortgage, you can call or write to us. Unfortunately, we won’t be able to update our records formally until we’ve received a copy of the Death Certificate. We’re sorry if you receive any letters directly addressed to the deceased before we’re able to complete this process.

There’s more information about what to do below.

Joint accounts

If the mortgage is in joint names and the property is owned as a ‘joint tenancy’, we’ll move the account into the sole name of the surviving borrower after you’ve sent us the Death Certificate. We won’t need any further documents from you.

Where the mortgage is in joint names and the property is owned as ‘tenants in common’ the deceased’s share of the property doesn’t automatically pass to the surviving borrower. In these circumstances, we’ll also need to see the grant of probate or certificate of confirmation.

If you’re worried about making your monthly mortgage payments after a bereavement, please call us and we’ll try to help. Simply talking to us won’t affect your credit file – and the sooner you get in touch the better, as there are often more ways we can help.

You can write to us at:

Jasper Mortgages

PO Box 111

Skipton

BD23 9FA

After you write, we’ll reply to acknowledge the bereavement and our letter will include details of the next steps you can take.

We’ll return any original documents that you send to us by recorded delivery, usually within seven working days.

Certified true copies of the original documents will be accepted. The person who certifies the copy must be a member of a professional body, such as one of the following:

- Solicitor

- Bank or Building Society official

- Chartered Accountant

- Chartered Surveyor

- Dentist

- Doctor

- Minister of Religion

- Councillor

- Person with FCA regulated status

- Post office official (through the post office’s certification service)

- Member of Parliament, or Scottish/Welsh/Northern Ireland Assembly Member

- Serving police officer

- Social worker

- Embassy, consulate, or high commission officer in the country of issue

- Notary Public

- Commissioner for Oaths

Sole accounts

To let us know about the death of someone who has a mortgage with us, please write to us and include the following information:

- The full name of the deceased customer and, if you know it, the mortgage account number

- Your full name, address, and contact number

- The full name and address of the personal representative of the estate (if it’s not you)

- The Death Certificate (the original or a certified copy) – we’ll return this to you later

- When you have it, a sealed copy of the grant of probate or certificate of confirmation

You can write to us at:

Jasper Mortgages

PO Box 111

Skipton

BD23 9FA

After you write, we’ll reply to acknowledge the bereavement and our letter will include details of the next steps you can take.

We’ll return any original documents that you send to us by recorded delivery, usually within seven working days.

Certified true copies of the original documents will be accepted. The person who certifies the copy must be a member of a professional body, such as one of the following:

- Solicitor

- Bank or Building Society official

- Chartered Accountant

- Chartered Surveyor

- Dentist

- Doctor

- Minister of Religion

- Councillor

- Person with FCA regulated status

- Post office official (through the post office’s certification service)

- Member of Parliament, or Scottish/Welsh/Northern Ireland Assembly Member

- Serving police officer

- Social worker

- Embassy, consulate, or high commission officer in the country of issue

- Notary Public

- Commissioner for Oaths

Power of attorney/ third party authority

Please note that a power of attorney or third party authority ends when a mortgage account holder dies. We can only discuss the mortgage account with someone when grant of probate/confirmation is received and registered on the mortgage.

Obtaining probate or confirmation

‘Probate’ or ‘confirmation’ is the legal right to deal with someone’s property, money and possessions (their ‘estate’) when they die. In England, Wales and Northern Ireland, if there’s a will, the person dealing with the estate will need to apply for a ‘grant of probate’. If there’s no will, they’ll need to apply for a ‘grant of letters of administration’. In Scotland, the person dealing with the estate will need to apply for ‘confirmation’.

There is guidance on applying for probate on the government website.

To apply for probate the person dealing with the estate will need to know the outstanding mortgage balance at the date of death. We can supply this information after we have received the Death Certificate, but we’re unable to discuss the mortgage account in more detail until we have received grant of probate or confirmation.

If you have a single buy-to-let mortgage with us and want to temporarily live in your property, you don’t need our permission and we won’t charge you a fee to do so.

You may need to tell your insurance company and you’ll also need to consider any implications for tax. You should think about this carefully and seek appropriate professional advice about anything you’re not sure of.

Moving into your property doesn’t mean we’ll treat your mortgage as a residential loan for regulatory purposes. We’ll continue to treat your loan as a buy-to-let mortgage.

To make sure that you’ll receive any letters we send to you you’ll need to tell us that the property address is your new correspondence address. We’ve explained how to do this in the first drop down box above.

Please note – if you have two or more buy-to-let mortgages with us, we won’t permit you to live in any of your mortgaged properties, even for a temporary period.

Update your contact details using Self-Serve

You can tell us about a change to your correspondence address or other contact details using Self-Serve, our secure online system, which is available 24 hours a day, 7 days a week.

Please note – if you have more than one mortgage account registered under the same username, you’ll need to make the changes for each account in turn.

Step 1

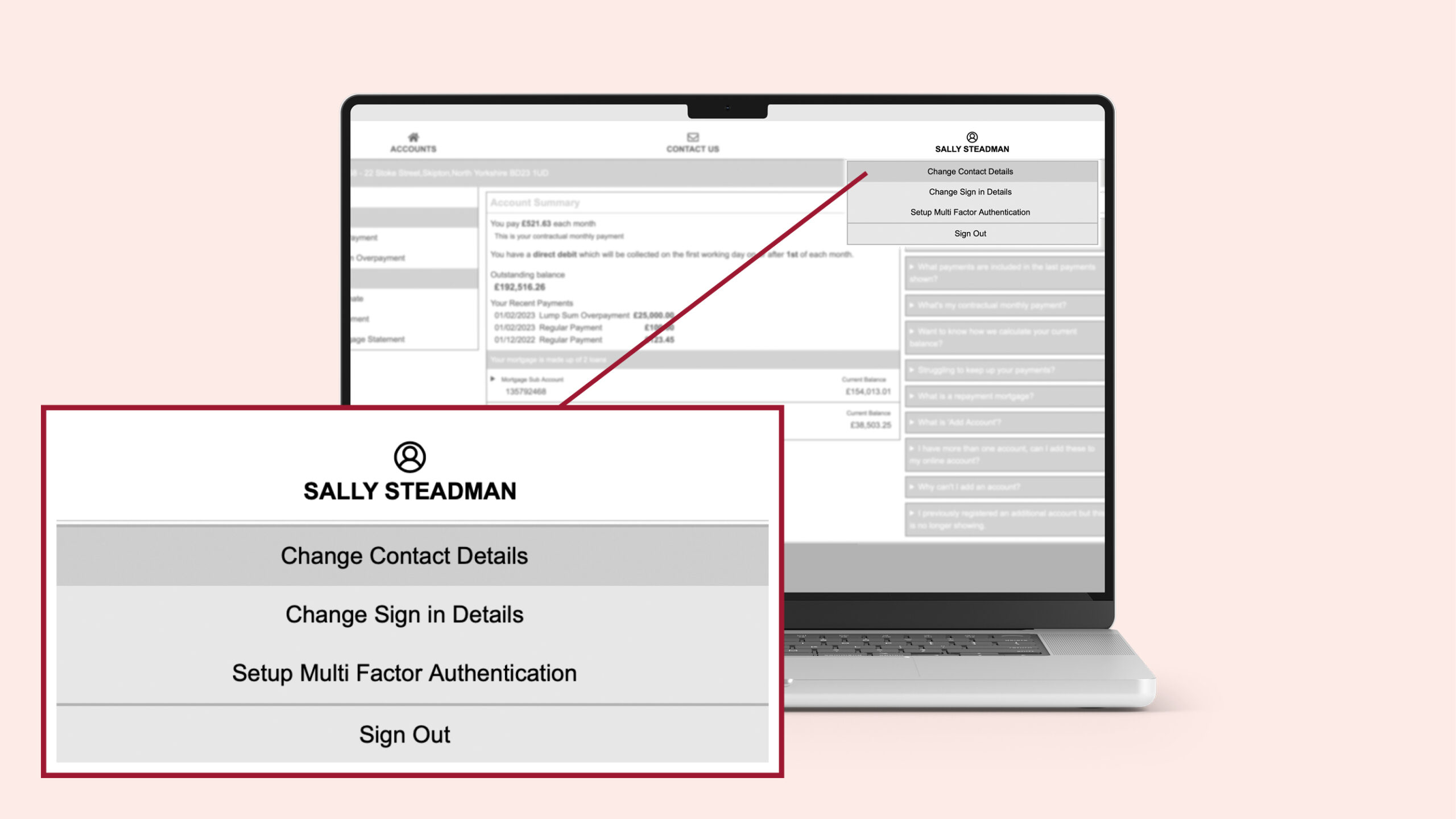

Simply sign in and click on your name in the top right of the screen, then click the Change Contact Details button in the pop-up menu.

Sign In/Register

Step 2

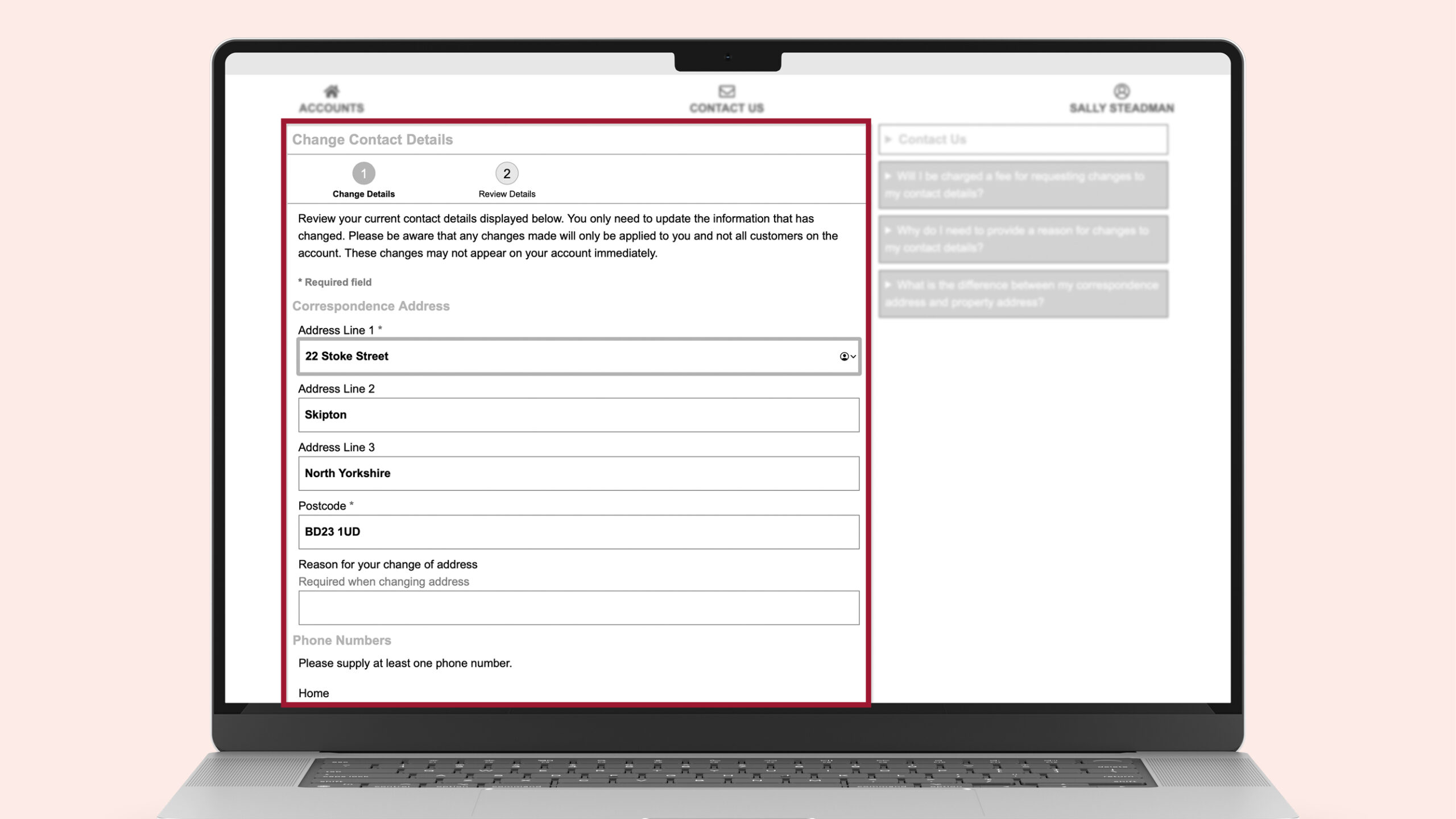

In the Change Contact Details screen, you can update your correspondence address and tell us the reason for this change. Further down this page you can also provide us with your up to date phone number(s).

Sign In/Register

Step 3

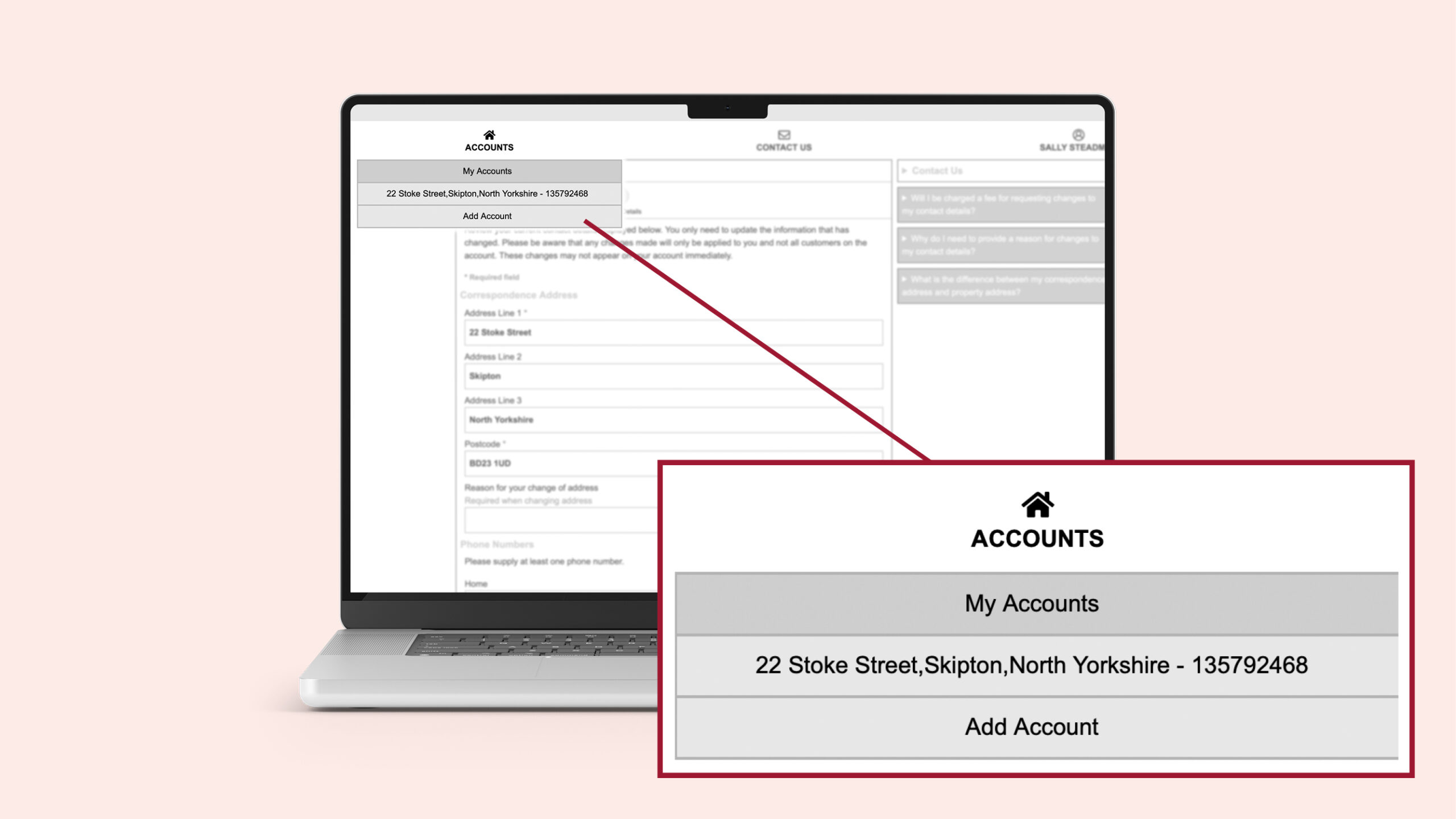

If you have more than one mortgage registered under the same username you’ll need to update your details for each account in turn.

To do this, click on Accounts in the top left of the screen. In the pop-up menu, you’ll see a list of each account that you’ve registered. You can click into each one to view and update the contact details for that mortgage.

If you haven’t already done so, and you have more than one mortgage with us, you can click Add Account to register the remaining accounts for Self-Serve using the same username.

A few important points:

- If you’re telling us about a new correspondence address, we may need to call you to understand more about the reason why you’re making this change.

- You won’t be able to update your correspondence address to an overseas address using Self-Serve. If you’re moving outside of the UK, please call us.

- Self-Serve is currently unavailable for mortgage accounts held only in the name of a limited company. If this is the case, please call us and tell us the changes you’d like to make.

Please note, this page contains links to external websites. We are not responsible for the content of external websites.